The Silent Predator: How to Spot Operator-Driven Stocks Before They Devour Your Capital

The stock market, for all its potential to build wealth, harbors a silent predator: the market operator. These aren’t your typical long-term investors or even short-term traders. They are manipulators, rigging the system for their own gain, often at the expense of unsuspecting retail investors. While SEBI, India’s market regulator, does an commendable job, waiting for their pronouncements is like waiting for an ambulance after the accident. By then, your capital might have already suffered irreparable damage.

The key lies in proactive vigilance. You need to develop an eagle eye for the subtle (and sometimes not-so-subtle) signs that scream “manipulation ahead!” Having navigated these turbulent waters myself, I’ve learned to look for these critical indicators, which, while not foolproof, offer a powerful shield against these “bad apples.”

Here’s how to sharpen your senses and identify potential operator-driven stocks in Stock Market:

1. The “Too Good to Be True” Price Rocket:

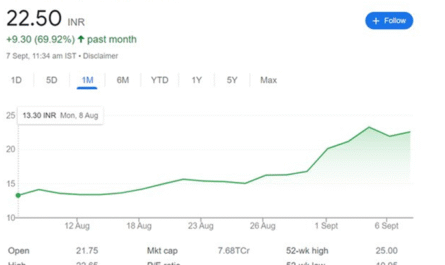

This is often the most glaring red flag. Imagine a stock that’s suddenly hitting its upper circuit, day after day, for weeks or even months. We’re talking about returns of hundreds of percent in a ridiculously short span.

- Ask yourself: Is there any genuine, fundamental reason for this meteoric rise? Has the company announced a groundbreaking discovery, secured a massive contract, or posted blockbuster earnings that truly justify this kind of explosion?

- The tell-tale sign: If the answer is a resounding “No,” and there’s no substantial news to back up the rally, you’re likely witnessing artificial pumping. Operators are creating an illusion of demand to lure in the masses.

2. The Whispering Giants vs. the Shouting Penny:

Market operators often prefer to play in the shallow end of the pool – small-cap and penny stocks.

- Why small caps? Companies with a market capitalization of ₹100 crore or less are far easier to manipulate. A relatively smaller amount of capital can create outsized price movements, making them fertile ground for rigging. While even giants like ACC were manipulated in the past (think Harshad Mehta’s infamous scam), the default hunting ground for today’s operators is often in the penny and small-cap space.

- The penny stock trap: Penny stocks (those trading for a few rupees per share) are particularly vulnerable. They often lack liquidity and investor interest until operators artificially inflate their prices, grabbing attention with unsustainable rallies. If a stock you’ve never heard of suddenly shows up with multi-fold returns in days, exercise extreme caution.

3. The Ghost in the Volume Machine:

Sometimes, a rally can be genuinely driven by positive sentiment. But differentiate between genuine interest and manufactured hype by looking at the trading volume.

- The healthy rally: A legitimate price increase is typically accompanied by robust, organic trading volume, where a significant number of shares genuinely change hands and are delivered to investors’ demat accounts.

- The operator’s trick: If a stock is hitting upper circuits on remarkably low volumes (perhaps only a few thousand shares traded daily), it’s a huge red flag. This often indicates “circular trading,” where operators are buying and selling amongst themselves to create the illusion of activity without genuine public participation. They’re making the pool look busy when, in reality, only a few people are splashing around.

4. The “Repeat Offender” Syndrome:

Just like any criminal, market manipulators often stick to what they know best. Rigging the same stock repeatedly is often easier than finding and setting up a new target.

- Your due diligence: Before committing your hard-earned money, take a moment to research the stock’s history. Has it seen similar inexplicable price spikes or crashes in the past? Are there any past SEBI actions or media reports hinting at previous manipulation? If a stock has a track record of suspicious activity, it’s best to steer clear.

> Beyond the Manipulation: Essential Investment Avoidances

While identifying manipulation is crucial, there are broader red flags that every smart investor should heed:

- Ignorance is not bliss: Never, ever invest in a company you don’t understand. If you can’t articulate how the company makes money, what its core business strategy is, or the purpose of its products/services, you have no business investing in it. Investing in complex sectors like semiconductors without foundational knowledge is a recipe for disaster.

- Debt: The Ship wrecker: High debt is like a gaping hole in a ship. Companies laden with excessive debt (a debt-to-equity ratio consistently above 1.0 is a strong warning sign) are inherently risky. They are vulnerable to interest rate fluctuations and economic downturns, making their long-term viability questionable.

- The Falling Knife Syndrome: Avoid catching a falling knife. If a stock’s price is consistently and significantly declining over a long period (think Geetanjali Gems, Yes Bank, Suzlon Energy in their troubled times), there’s almost always a valid reason. The market is punishing the company for fundamental weaknesses. Don’t assume you know better than the collective wisdom of the market.

Read Also: Can is intraday trading and how is it performed?

The stock market is an incredible engine for wealth creation, driven by a complex ecosystem of intermediaries, institutions, traders, and investors. But like any arena where significant money is involved, it attracts those with ill intentions. By understanding the signs of operator-driven stocks and adopting a disciplined approach to your investments, you can safeguard your capital and truly participate in the market’s potential for building long-term wealth, rather than becoming another statistic in a manipulator’s ledger. Stay vigilant, stay informed, and invest wisely!